Prepaid Expenses Examples, Accounting for a Prepaid Expense

Content

If you’re using cash basis accounting, you don’t need to worry about prepaid expenses. In cash accounting, you only record an expense when money changes hands. The process of recording prepaid expenses only takes place in accrual accounting. If you use cash-basis accounting, you only record transactions when money physically changes hands. Instead, they provide value over time—generally over multiple accounting periods.

Where do you record prepaid insurance?

Prepaid expenses are recorded as assets on the balance sheet.

Save time, reduce risk, and create capacity to support your organization’s strategic objectives. BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence.

Everything You Need To Master Financial Modeling

This reduces the number of entries required, saving time and reducing the risk of errors. By accounting for prepaid insurance, businesses can manage their finances effectively, plan for future expenses, and maintain the necessary level of insurance coverage. Prepaid insurance can be paid monthly, quarterly, or yearly depending on the insurance plan and policies as well as the company’s preference. The prepayment will hence, provide insurance coverage for the company within the period covered by the prepayment.

You don’t want to miss getting the space and hence pay the rent amount for a month or quarter in advance. By simply looking at the income statement, it may not be easy to figure out what the cash outflow for insurance was in specific period. Just like any balance sheet account, we can prepare a balance sheet rollforward.

Journal Entry for Prepaid Expenses

Reduce risk and save time by automating workflows to provide more timely insights. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Volha is an experienced copywriter with 10+ years experience writing for the information technology and services industry and a 5+ years sole proprietorship background. Passionate about all things tech, she is especially interested in topics lying at the confluence of business and technology. The Insurance Expense would now be shown in the income statement for January and Balance Sheet prepared for Jan 31st would show the Prepaid Insurance amount or $2,750.

- Repeat the process each month until the policy is used and the asset account is empty.

- Despite its name, prepaid expenses are not recorded as expenses upon their initial payment.

- Hence, it can be recorded by using the asset method and expense method of accounting.

- A prepaid expense is recorded as a type of asset on the balance sheet and as an expense on the income statement when it’s utilized.

- Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company.

As for the second portion, which involves the incoming benefits or services used in the coming period, this represents current assets, otherwise known as unexpired expenses, prepaid expenses, or expenses paid in advance. The journal entry for prepaid insurance is a debit to the prepaid insurance account and a credit to the cash account or the company’s bank account. prepaid insurance journal entry This journal entry records the transaction concerning the purchase of insurance premiums by a company within a specified accounting cycle. The adjusting entry is necessary as it records the amount of insurance that has been used up by the company and also ensures accurate reporting of the company’s financial standing in its various financial statements.

Pay the expense

This allocation is represented as a prepayment in a current account on the balance sheet of the company. Prepaid expenses are recorded as an asset on a company’s balance sheet because they represent future economic benefits. Prepaid expenses are important in accounting because they represent a prepaid asset that will be used in future periods. They also impact the accuracy of financial reporting, as they can affect the balance sheet and income statement. As the payment is a transaction between two asset accounts, there’s no cash outflow in the accounts. Hence, till the expenses are debited, the money is available with the company.

Redwire Earnings Soared in First Quarter – Parabolic Arc

Redwire Earnings Soared in First Quarter.

Posted: Thu, 11 May 2023 07:00:00 GMT [source]

Utilising the assets under the prepaid expenses account is necessary within the first 12 months. However, if the expenses are not debited within a year, the asset gets recorded as a long-term non-current asset. From the perspective of a business, the initial transaction of cash to a prepaid account is a debit expense https://www.bookstime.com/articles/what-are-t-accounts between two current accounts. As these accounts are both asset accounts, they do not increase or decrease any value on the balance sheet. Usually, expenses recorded as prepaid expenses by organisations are for advance rent payments, insurance payments and other recurring expenses commonly paid in advance.

How are Prepaid Expenses Recorded?

These adjusting entries are necessary because they have a direct impact on the company’s financial statements which get issued either monthly, quarterly, or yearly. Note that the amount adjusted monthly is the total insurance payment divided by 12 which is the number of months in a year. That is $30,000/12 to arrive at the $2,500 adjusting entry for prepaid insurance that will be made monthly. Prepaid Expenses are productive to a company’s accounting records, and it is crucial to understand their application in a financial statement. However, this expense is not similar to accrued expenses as the latter is a liability, and the prepaid expenses are assets.

- Once the prepaid expense is used or consumed, it is recognized as an expense on the income statement.

- If you’re using manual ledgers for your accounting, you can create a spreadsheet outlining your monthly expenses that will need to be recorded in your general ledger as an adjusting entry.

- We always start with the beginning balance (prior year ending balance), add the item that would increase the balance sheet account, and then subtract the expense recognized in the period.

- Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months).

- This allocation is represented as a prepayment in a current account on the balance sheet of the company.

- By doing so, companies can rest assured that their financial reports and statements are consistently accurate and reliable.

It is only as the benefit of the purchased product or service gets realised over time the value of the asset would be reduced, and thus, the corresponding amount would be expensed to the firm’s profit and loss statement. In short, the prepaid expense must be correlated with the accounting period in which the asset delivers its benefits. These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Prepaid expenses represent expenditures that have not yet been recorded by a company as an expense, but have been paid for in advance.

Examples

To help businesses stay on track with their prepaid expenses, it would always be a good idea to consider adopting an automated accounting software to ensure that no information slips through the cracks. By doing so, companies can rest assured that their financial reports and statements are consistently accurate and reliable. That way, Kolleno helps to ensure that the business can manage its finances in the most user-friendly and efficient way, as well as strengthen its customer relationships. This journal entry is completed to establish your Prepaid Insurance asset account that represents the prepaid amount.

How do you record prepaid insurance in accounting equation?

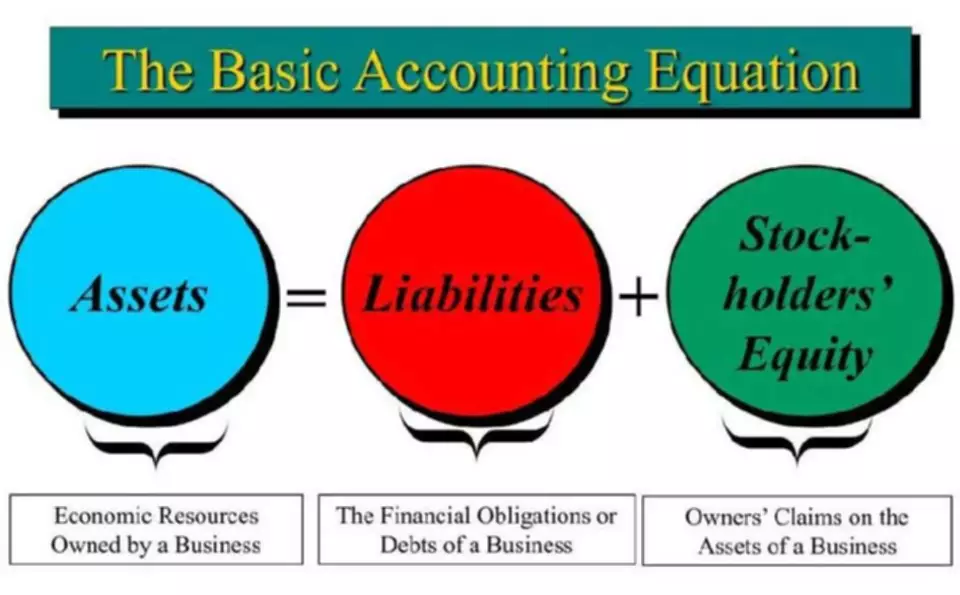

In this case, Prepaid Insurance is classified as current assets on the Balance Sheet. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company.

As the benefits of the good or service are realized over time, the asset’s value is decreased, and the amount is expensed to the income statement. Upon the end of every accounting period, a journal entry will need to be recorded for the expense incurred during that timeframe and in accordance with the amortisation schedule. By doing so, this documents the incurring of the expense during that financial period as well as lower the prepaid asset by the corresponding quantity. Recording a prepaid expense requires a prepaid expense journal entry that accurately records the transactions in the accounting books.